- What are the business vehicles available for registration in Kenya?

- Companies (private limited company, public limited company, foreign company, or company limited by guarantee as set up under the Companies Act, 2015)

- Business Names (can be a Sole Proprietorship or Partnership)

- The Partnership Act defines a partnership as meaning the relationship which exists between persons who carry on business in common with a view of making a profit.

- Limited Liability Partnerships

- This is a partnership in which one or more partners have limited liability in the partnership. Unlike an ordinary partnership, a limited partnership must be registered in accordance with the Limited Liability Partnership Act and possesses separate legal identity from the partners.

- Non-Governmental Organizations (governed by the Non-Governmental Organizations Co-ordination Act No. 19 of 1990)

- Trusts (relevant laws being the Trustee Act, Cap 167 and the Trustees (Perpetual Succession) Act, Cap 164 of the Laws of Kenya)

- What is a Sole Proprietorship?

- A sole proprietorship is a trading business owned by a single person – it is an unincorporated business that is run by only one person.

- It is also referred to as a sole trader or a proprietorship.

- What are the advantages of a Sole Proprietorship?

- The registration procedure is simpler and less costly as compared with other business structures;

- It is quick and easy to register and to cease carrying on with the business;

- It has minimal formal compliance requirements;

- The sole proprietor enjoys all the profits of the business;

- The sole proprietor has absolute control of the business operations; and

- It is possible to convert the sole proprietorship to a limited liability company once the business expands.

- What are the disadvantages of a sole proprietorship?

- The liability of a sole proprietorship is unlimited, meaning that the sole proprietor is liable for all debts incurred by the business;

- The sole proprietor has to personally raise capital for the business;

- The personal assets of the sole proprietor are not protected even when the debt is incurred by the business;

- A sole proprietorship attracts less tax-deductible costs and allowances, redeemable against profits;

- The business name of a sole proprietorship is not protected unless by a trademark, which is expensive; and

- It becomes difficult for a proprietor to manage the business alone as the business expands.

- How do I register my own business as a sole trader?

- To register a business as a sole trader, you will need to visit https://www.ecitizen.go.ke/ and go to the Business Registration Service (BRS) agency icon and proceed as follows:

-

-

- Choose a name for your business: the name should be unique; it should not be similar or same as a name that is already in existence or contradicts public policy. You are required to propose at least five (5) names;

- Make an application to have the name reserved: this is done by filling the Form CR14. Put the five names you propose starting with the most preferred one;

- Pay a name reservation fee of One Hundred Kenyan Shillings (KES 100); and

- The Companies Registry will check if the names you have provided are already in existence or are in breach of public policy before approving or refusing to approve the name. Once you register the business name, you can start trading under the name, subject to meeting other applicable regulatory requirements such as permits (if applicable) and those relating to tax.

-

- How do I tell whether the name I intend to register as my business name already exists as someone else’s?

- You can apply for a name search online at an application fee of One Hundred and Fifty Kenyan Shillings (KES 150) per name at https://www.ecitizen.go.ke/

- Will I be subjected to tax as a sole proprietor?

- YES – to operate a business in Kenya, you must be registered for taxation with the Kenya Revenue Authority (KRA).

- Some of the taxes that you might be imposed on are Value Added Tax (VAT); Turnover Tax; Local Service Tax; and Pay as You Earn Tax (PAYE) in case you have employees.

- Do I need a business permit to run a business after registering my business name?

- YES, you do – to register for a business license, visit https://www.businesslicense.or.ke/index.php/index/index/id/1

- Once you are on that website, you will need to select the following as they apply to your business:

-

-

-

- Business location;

- Industry; and

- Business

-

-

- Once you have selected the areas above, you will find information on:

-

-

-

- Permit validity, license fee, permit requirements, licensing body responsible, and downloadable application forms.

- Once you apply for your business license, you can download the same at the e-business portal via the link https://www.ebusiness.go.ke/ebusiness.html

-

-

- Can I use a 3rd party or agent to register the business for me?

- Yes, you can.

- The e-citizen portal provides options of persons who may incorporate a company on your behalf, being shareholders, directors, or lawyers.

- That means that authorized persons can use their e-citizen accounts to incorporate a company for you, but later transfer the application to you once concluded.

- What is the difference between companies and partnerships?

- In a partnership, each partner is liable for the debts and liabilities of the firm without limits (except in limited liability partnerships) whereas in companies the directors and shareholders of the company are not liable for the debts and liabilities incurred by the company (unless it is an unlimited company);

- A partnership has no separate existence from the partners while a company is a separate legal person from the directors and members of the company and can be sued in its own name and own property in its own name;

- A partnership has no perpetual succession unlike a company so that the death, retirement or bankruptcy of a partner ends the partnership.

- What is the advantage of incorporating a company over a partnership?

- A company has separate legal personality from the directors of the company. This means that it can own land and contract in its own name, own shares in its own name and sue and be sued in its own name unlike a partnership.

- Companies have limited liability meaning that the assets of the shareholders cannot be sold to pay the liabilities incurred by the company. This is subject to them not engaging in fraudulent activities in which case the liability may befall them.

- Companies offer wide range of varieties in terms of raising capital. Shareholders may sell shares in order to finance the company.

- Ownership is easily transferable. The ownership of a company is easily transferable with the transfer of shares from one person to another.

- What are limited liability partnerships?

- A limited liability partnership is a partnership in which some or all partners have limited liabilities. It allows these partners to separate their personal liability from liability of the partnership.

- It has the protection of a limited company with the flexibility of a partnership.

- Unlike regular partnerships, LLPs are registered and once registered they become a body corporate with perpetual succession, a separate legal personality.

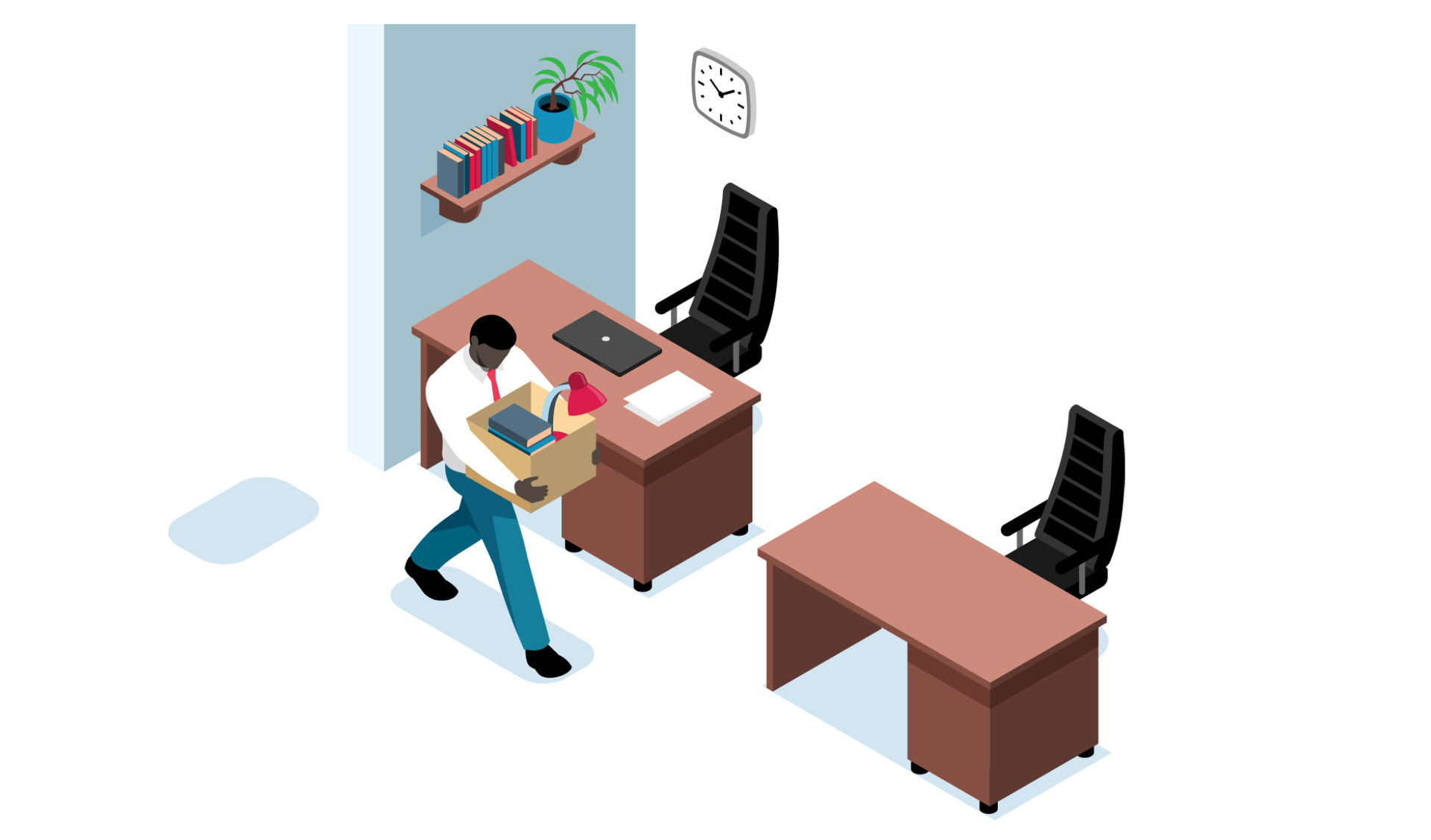

- What are the reasons for removal of a partner from a partnership?

- Death of the partner;

- Partner is expelled by his co-partners;

- Partnership is dissolved;

- Court makes an order to remove the person as a partner; or

- A bankruptcy order or an award for sequestration is made against the person.

- When does a person cease to be a partner in a partnership?

- On death of the partner;

- When adjudged bankrupt and not discharged for 3 months;

- On dissolution of a partnership;

- On retirement or resignation of a partner;

- On expulsion by fellow partners;

- When the partner becomes incapacitated, that is, becoming of unsound mind; and

- On an order of the court.

- What is the procedure for removal of a partner from a partnership?

- An order is made against the partner by the court;

- The whole or part of the partner’s shares in the partnership is subjected to an attachment in execution in respect of a debt which is not a partnership debt;

- The partners should issue the partner with a notice of not less than three months of their intention to remove the partner; and

- An expulsion notice shall not have effect before its expiration if the order of the court is revoked.

- What is incorporation of a company?

- Incorporation is the process by which a new or existing business registers as a company. A business cannot be registered as a company unless it has been incorporated or registered under the Companies Act, 2015.

- Can a foreigner incorporate a company in Kenya?

- Yes. A foreigner can incorporate a company in Kenya as long as they obtain a work permit. With the work permit comes the alien identity card and tax registration.

- From then on, the foreigner can go through the normal process for incorporation of companies.

- However, Section 233 of the Companies Act prohibits any person who has been in any way restricted under any foreign law from acting in connection with the affairs of a company from becoming a director, promoting or incorporating a company in Kenya. These foreign restrictions may be either due to misconduct, incompetence or mental or physical incapacity.

- Can minors be directors and/or shareholders in a Company?

- No, A child cannot be a Director in a Company (Section 131 of the Companies Act). A child can only be a Shareholder not a Director.

- What are the effects of incorporation?

- Limited liability:

Barring any contrary evidence of fraud or gross misconduct on their part, since a company is separate from the members who constitute it, the members are not liable for its debts. They cannot be held personally liable for the debts of the company.

This was well established by the House of Lords in the case of Salomon v Salomon & Co. Ltd. [1897] AC 22 where the legal principle of the corporate veil was espoused which established the company as a separate legal person from its directors and shareholders. This corporate veil could however be pierced on occasion of fraud or grave misconduct or negligence and the liabilities of the company taken up by its members.

- Holding property:

A company once incorporated acquires corporate personality distinguishable from that of its members. It can therefore hold property in its own name. What this means is that in an incorporated association, the property of the association is the joint property of all the members and although their rights therein may differ, the joint property must be dealt with according to the rules of the incorporated association and no individual member can claim any particular asset to that property.

- Suing and being sued:

As a separate legal person, a company can act in its own name and enforce its legal rights. Conversely, it may be sued for breach of its legal duties. The only restriction on a company’s right to sue is that it must always be represented by an advocate in all its actions and it must authorise institution of suits. This principle referred to as the “Proper Plaintiff Rule” was advanced in the case of Foss v Harbottle (1843) 2 Hare 461, 67 ER 189, which states that in any action in which a wrong is alleged to have been done to a company, the proper claimant is the company itself. However, there are exceptions to this rule which allow for protection of minority shareholders.

- Perpetual succession:

As an artificial person, the company has neither body, mind nor soul. It has been said that a company is therefore invisible and immortal and thus exists only under the Law. It can only cease to exist by the same process of law which brought it into existence otherwise it is not subject to the death of the natural body. This means that even though the members may come and go, the company continues to exist.

- What is the difference between incorporation and registration of a business association?

- Notably, registration does not mean incorporation as there are institutions such as societies which though registered, are unincorporated and do not enjoy the recognition as separate legal entities from the members who formed it. They may transact business in their own name, own property in their own name, be held liable on any contracts entered into by the association but its members are jointly and severally liable to account for its debts and obligations of such unincorporated associations without limitation.

- What is liability of a company?

- Liability means the extent to which a person can be made to account by the law. He may be made to be accountable either for the full amount of his debts or else pay towards that debt only to a certain limit and not beyond it.

- In the context of company law therefore, liability may be limited either by shares or guarantee.

- What documents are required to incorporate a company?

- Company registration form (Form CR1);

- Application for reservation of a company name (Form CR14);

- Memorandum of association (Form CR2, CR3 or CR4 depending on company being incorporated);

- Particulars of the directors and secretary (Form CR6 and Form CR10);

- Statement of nominal capital;

- Articles of Association (however if model articles are adopted in their entirety, there is no need for a copy to be lodged at the Company Registry for filing);

- Notification of the residential address of the directors and company secretary (Form CR8 and CR12);

- Copy of the Kenyan national identification of each director and secretary or, copy of the Kenyan foreigner certificate, or in the case of a director who is not a Kenyan citizen and is not resident in Kenya, a copy of the director’s passport;

- Passport-sized photograph of each director and the company secretary.

- How do I initiate the business registration process?

- This is done online on the eCitizen website, through the Business Registration Service platform on https://www.brs.ecitizen.go.ke or https://services.brs.go.ke

- What is a Certificate of Incorporation?

- This is the conclusive evidence that the requirements of the Companies Act as to the registration have been complied with and that the company is duly registered under the Act. The certificate will state:

-

-

- The name and registration number of the company;

- Whether it is a limited or unlimited company and if limited, whether limited by shares or by guarantee;

- The date of incorporation;

- Whether it is a public or private company;

-

- This Certificate must be signed sealed and authenticated by the Registrar of Companies.

- How much does it cost to register a company?

- The total registration fees for all companies is KES. 10,750/=. This fee comprises of the registration fee, official search results and convenience fee. Note that no stamp duty is payable at the point of incorporation of a company.

- Who is a member of a company and who may be a member?

- A member of a company is anyone who has subscribed to the memorandum and articles of association of the company.

- Anyone including infants or minors may be registered as members of a company. These minors may revoke their membership after attaining the age of majority. Members may also include personal representatives, trustees upon bankruptcy and a body corporate if it’s authorized in the memorandum of associations of the company.

- What is the difference between a member and shareholder of a company?

- A member of a company is a person who has subscribed to the memorandum of the company, while a shareholder owns shares in the company.

- All shareholders whose names are entered in the register of members are members but not all members are shareholders.

- What is a holding company?

- A holding company in relation to a subsidiary company is a company that:

-

-

- Controls the composition of the subsidiary company’s board of directors;

- Controls more than half of the voting rights in its subsidiary company;

- Holds more than half of the subsidiary company’s issued share capital; or

- Is a holding company for a company that is the subsidiary’s holding company.

-

- What are the Articles and Memorandum of Association of a company?

- The Memorandum of Association confers the powers and objects of the company. It includes the name of the company, name of each subscriber and an indication of the number of shares they wish to take.

- The Articles of Association (a Company’s Constitution) deals with how this power should be exercised. They regulate the manner in which the company’s affairs are to be managed. They deal with the issue of shares, the alteration of share capital, general meetings, voting rights, appointment of directors, powers of directors, payment of dividends, company accounts and winding up to give a brief overview. They also provide a dividing line between the powers of shareholders and those of the directors.

- Must I generate the Articles and Memorandum of Association for my company and what is the legal effect of these documents?

- Under the Companies Act, it is only mandatory for a company limited by guarantee or an unlimited company to register the Articles of Association and Memorandum of Association. A company limited by shares may or may not register its Articles of Association. Where you elect to not do so, it will be assumed that the model Articles of Association contained in the Companies Act are adopted by the Company.

- On the legal effect of these documents, Section 30 (1) of the Companies Act which provides for the effect of the company’s constitution states that, “A company’s constitution binds the company and its members to the same extent as if the company and its members had covenanted agreed with each other to observe the constitution.” In effect, this section has been interpreted by the courts to mean that the memorandum gives rise to a contract between the company and each member.

- Where can I get information on Companies?

This information is available on the Business Registration Service Website at https://brs.go.ke/index.php. The Business Registration Service Website offers four (4) main services:

-

-

- Companies Registry

- The Official Receiver in Insolvency

- The Collateral Registry (Movable Property Security Rights Registry)

- Hire Purchase Registry

-

The tabs for Downloads and the Information Centre contains very user-friendly information that can guide users on various processes at the Companies Registry. Examples of useful tools under that website include:

-

-

- Under the tab for downloads, you will find Practice Notes 1-8 which include PN/01 on Incorporation of Companies, PN/02 on Statutory Risks and Research, PN/03 on Event Driven Filings etc.; Forms / Regulations; Publications; Legislation; Model Articles and Manuals.

- Under the Information Centre Tab, you will find information such as: How to register a local business entity; Foreign company incorporation; Changes and returns filings; Voluntary strike off, dissolution and restoration etc.

-

- Who is a Beneficial Owner?

- A beneficial owner is a person who ultimately owns or controls a legal person or arrangements or the natural person on whose behalf a transaction is conducted, and includes those persons who exercise ultimate effective control over a legal person or arrangement.

- What are the requirements for one to be a Beneficial Owner in a Company?

One has to, directly or indirectly:

-

-

- Hold at least ten percent (10%) of the issued shares of the company;

- Exercise at least ten percent (10%) of the voting rights in the company;

- Hold the right to appoint or remove a director of a company; or

- Exercise significant influence or control over a company.

-

- What are the Salient provisions of the Companies (Beneficial Ownership Information) Regulations 2020?

- The Companies (Beneficial Ownership Information) Regulations 2020 give effect to section 93 A of the Companies Act No. 17 of 2015.

- It provides for obligations of Beneficial Owners and Companies in relation to Beneficial Owners’ particulars and information.

- Companies are required to investigate, obtain, and enter particulars of the Beneficial Owners in the Register, while the Beneficial owners are required to disclose their particulars to the company.

- Where Beneficial Owners fail or refuse to give their particulars, companies are mandated to issue them with a warning notice for the non-compliance. In addition to the notice, the company is mandated to restrict the relevant interest of a person who does not comply with the notice.

- The effects of this restriction are that any transfer of interest is void, no rights are exercisable in respect of the interest, no shares may be issued in light of an offer made to the interest holder, and no payment may be made of sums due from the company in respect of the interest.

- Companies are restricted from disclosing any information regarding the Beneficial Owners. A Company that discloses any information regarding Beneficial Owners commits an offense.

Compiled by: George Karuthui Kamau, Susan Wairimu Munene, Sylvia Wambui Waiganjo, Francis Kabuchu and Doreen Khizi Kithinji.